Value At Risk Beispiel | The most popular and traditional measure of risk is volatility. (var is capitalized differently to distinguish it from var, which is used to denote variance.) var is widely used by financial institutions. Value at risk (var) is an important risk measure used by the portfolio managers across the globe. The risk in value at risk refers to risk of loss. Im folgenden erklären wir die definition, die formel und gehen auf die berechnung mit einem beispiel.

The main problem with volatility, however, is that it does not care about. Value at risk is a financial risk measure which calculates the value of loss for a given significance level and time horizon. Definitionen des value at risk aufgeführt. Conventionally, however, this number is usually reported/presented as a positive number. show full abstract measure in a newsvendor framework and.

Conventionally, however, this number is usually reported/presented as a positive number. Though its advantages clearly weigh more than the. Du willst das thema auf anhieb gut verstehen? Var is applicable to many different assets, including. Value at risk (var) is a measure of the risk of loss for investments. Beispiele · definition · übungsfragen. Value at risk (var or sometimes var) has been called the new science of risk management, but you don't need to be a scientist to use var. Value at risk (var) is a statistic used to try and quantify the level of financial risk within a firm or portfolio over a specified time frame. Value at risk (var) is an important risk measure used by the portfolio managers across the globe. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. Der value at risk oder kurz var, ist ein zentrales risikomaß zur bestimmung des höchsten zu erwartenden verlustes. It was developed as a result of discussions surrounding the parties determined that value risks were of greater consequence, and var was born. Der value at risk wird von banken und investmentgesellschaften in der regel täglich neu berechnet.

Du willst das thema auf anhieb gut verstehen? Value at risk (var) is a measure of the risk of loss for investments. Though its advantages clearly weigh more than the. Finanzmarktökonometrie am beispiel des value at risk. In unserem beispiel bedeutet das.

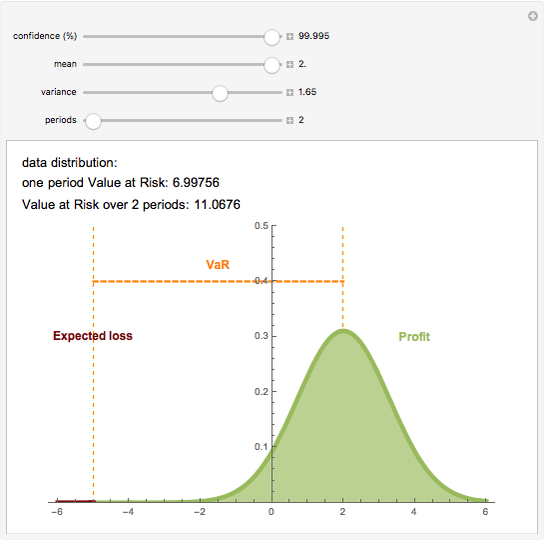

Value at risk (var) is an important risk measure used by the portfolio managers across the globe. Value at risk is a financial risk measure which calculates the value of loss for a given significance level and time horizon. Es handelt sich um das quantil der verlustfunktion: Value at risk (var or sometimes var) has been called the new science of risk management, but you don't need to be a scientist to use var. Darüber hinaus müssen bestimmte voraussetzungen für eine aussagekräftige berechnung des value at risk gegeben sein. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. Du willst das thema auf anhieb gut verstehen? Value at risk (var) estimates the risk of an investment. Var is applicable to many different assets, including. Beispiele · definition · übungsfragen. Value at risk is a risk management tool developed by till guldimann at j.p. Value at risk (var) is the maximum potential loss expected on a portfolio over a given time period, using statistical methods to calculate a confidence level. Its ease of understanding and wide acceptance by the regulatory authorities makes it even more favorable for the fund management companies to adopt.

Value at risk is a financial risk measure which calculates the value of loss for a given significance level and time horizon. Du willst das thema auf anhieb gut verstehen? Its ease of understanding and wide acceptance by the regulatory authorities makes it even more favorable for the fund management companies to adopt. The risk in value at risk refers to risk of loss. Value at risk (var) is a statistic used to try and quantify the level of financial risk within a firm or portfolio over a specified time frame.

Value at risk (var) is a statistic used to try and quantify the level of financial risk within a firm or portfolio over a specified time frame. Its ease of understanding and wide acceptance by the regulatory authorities makes it even more favorable for the fund management companies to adopt. Conventionally, however, this number is usually reported/presented as a positive number. Finanzmarktökonometrie am beispiel des value at risk. In unserem beispiel bedeutet das. It was developed as a result of discussions surrounding the parties determined that value risks were of greater consequence, and var was born. (var is capitalized differently to distinguish it from var, which is used to denote variance.) var is widely used by financial institutions. Losses are a negative impact on portfolio value. Du willst das thema auf anhieb gut verstehen? show full abstract measure in a newsvendor framework and. The risk in value at risk refers to risk of loss. Ein investmentfonds hält 100.000 aktien einer einzelnen ag. Als beispiel lässt sich etwa die wertentwicklung einzelner aktien oder eines aktienportfeuilles heranziehen.

Value At Risk Beispiel: Finanzmarktökonometrie am beispiel des value at risk.

0 Please Share a Your Opinion.:

Post a Comment